You know my goal around here is to help you add ease to the legalese. (I can’t believe I’ve been doing it for more than a decade now!)

And for that entire time, my advice about how to keep your LLC legit hasn’t changed–until this year. When on January 1, 2024, a new law went into effect for LLCs to report their beneficial ownership information.

I hope you’ve heard about this new requirement and are ready to take a few minutes to knock it off your to-do list.

If you are wondering how to do it so you can keep your LLC legit, you’re in luck!

I’ll cover what this law is, how it impacts your business, and outline four specific things you should do to keep your LLC on the legal up and up.

Ready? Let’s dive into why Congress passed this law.

Why do you now need to report Beneficial Ownership Information?

In case you haven’t heard, in 2021, Congress passed the Corporate Transparency Act. The public policy behind this law is to prevent criminals from using anonymous shell businesses for illegal activities.

Since LLCs and corporations are created on a state-by-state basis, there is no federal database of who owns these businesses. That’s why Congress passed this law: to create a federal database of who owns an LLC or corporation, so if these businesses participate in financial crimes, the government knows who is responsible.

The Financial Crimes Enforcement Network (FinCEN) enforces this law. They are responsible for protecting our financial networks from money laundering, fraud, terrorist financing, or corruption.

And the law went into effect on January 1, 2024.

Simply put, if you filed a form with a U.S. state or tribal government to create your business, you’ll need to comply with this law.

This means if you are any of the following, you’ll need to comply:

- Corporation

- LLC

- Limited Partnership

- Limited Liability Partnership

- Professional corporation or professional LLC

You do NOT need to comply if you are a sole proprietorship or a general partnership.

Note: What matters is your entity type. Are you an LLC or corporation? If so, you need to comply. Your IRS tax status (i.e. an LLC taxed as a sole proprietorship, doesn’t matter.)

While this might seem onerous, I’ll let you know that the form is pretty simple to complete. I did it for my business in less than 9 minutes (and that included grabbing and taking a photo of my ID).

4 actions you should take regarding the Beneficial Ownership Information Report

Proactive business owners like you and me will keep our creative businesses on the legal up and up by taking a few minutes this week to knock this reporting requirement out.

Here are the four things you can do today to not only complete this filing but make sure that your LLC stays on the legal up and up for years to come.

#1. Ensure you file your BOIR within the filing windows

There is a grace period to file your Beneficial Ownership Information Report.

For all LLC created on or after January 1, 2025, your grace period is 30 days from your LLC being approved by your state.

This means if your LLC is approved by your state on January 15th, then you have until February 14th to file the report.

And if you fail to file this report within these grace periods, it can lead to stiff civil and criminal fines and penalties. Including:

- For each day you haven’t filed a civil penalty of $500 per day

- Up to a $10,000 criminal penalty and/or two years in prison

Needless to say, spending less than 10 minutes to avoid these penalties is a wise use of your time.

#2. Gather what you’ll need to file your BOIR

As I mentioned above, I completed my Beneficial Ownership Information Report for my LLC in less than 9 minutes. And because I did it without looking at any resources first, I was slowed down because I didn’t know exactly what the form required.

So that you can complete it even faster than me, here’s what you’ll need to know/gather:

- A device or computer with internet access

- Your LLC’s EIN (Don’t have an EIN yet? Get one first using this resource.)

- What state you created your LLC in

- An electronic image of each business owner’s non-expired U.S. State/Tribe-issued driver’s license or U.S. passport (file type must be JPG, JPEG, PNG, or PDF and must be less than 4 MB in size)

#3. Step-by-step instructions to file your BOIR

It’s only natural to feel frustrated that there’s one more piece of legal red tape you need to comply with.

Luckily, I’ll walk you step-by-step through the Beneficial Ownership Information Report so you can beat me and file it in less than 9 minutes.

Start the filing process

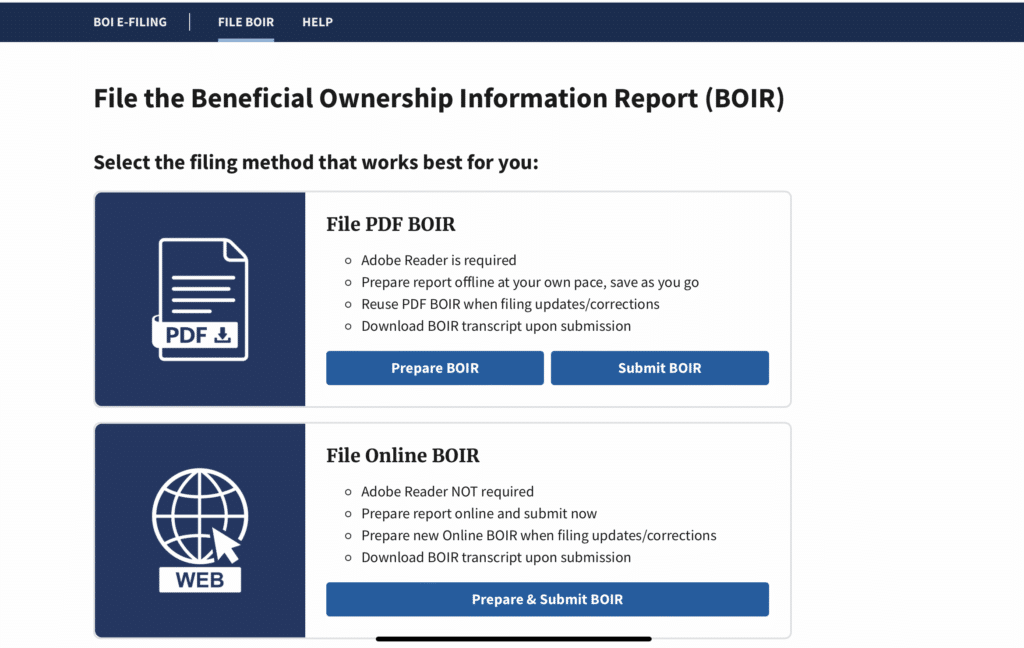

There are two methods for filing your Beneficial Ownership Information Report (BOIR). Since PDFs often are not accessible to those using screen readers (and can be hard to complete on a tablet/phone), I’m providing instructions for the Online BOIR. If you would like to complete the PDF version, you can see FinCEN’s PDF instructions here.

Your action items here are to:

- Go to the BOI e-filling website

- Click the File BOIR button

- Click the Prepare & Submit BOIR button under the File Online BOIR section

- Review the warning and click the “I agree” button

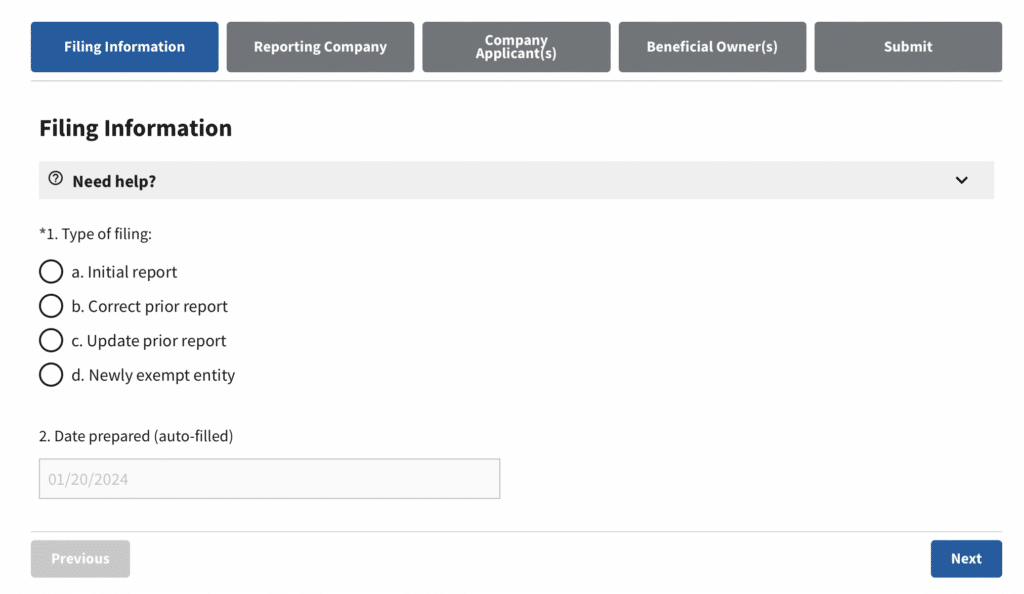

Filing Information Tab

Since we’ll be filing our initial BOIR, this tab is super easy and only requires selecting Initial Report in Question 1.

The date prepared will be greyed out since it is auto-filled with the current date and can be ignored.

Your action items on this Tab are to:

- Select the Initial Report option for Question 1.

- Click the Next button

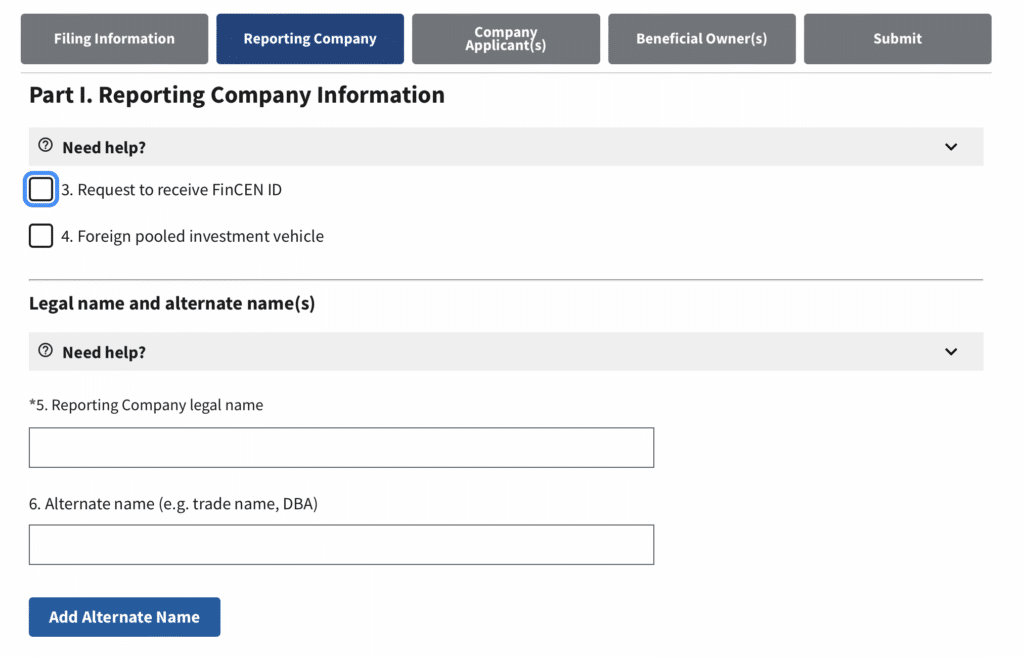

Reporting Company Tab

The Reporting Company tab is used to provide information about your LLC/corporation.

A couple of notes about this tab:

- In Question 3, you’ll have the option to request a FinCEN ID, if your business doesn’t have one already. Unless for some strange reason, you have one, you should check this box.

- If your LLC has multiple brands or businesses under it, then you’ll need to enter any DBA or tradenames in Box 6. If you have more than 1 DBA then use the “Add Alternate Name” button to add additional fields (up to 99 can be entered!) (Not sure if your LLC needs a DBA? Check out this DBA resource.)

- If your LLC doesn’t have an EIN yet, order this first. This resource explains how to get an EIN instantly for free from the IRS in less than 5 minutes.

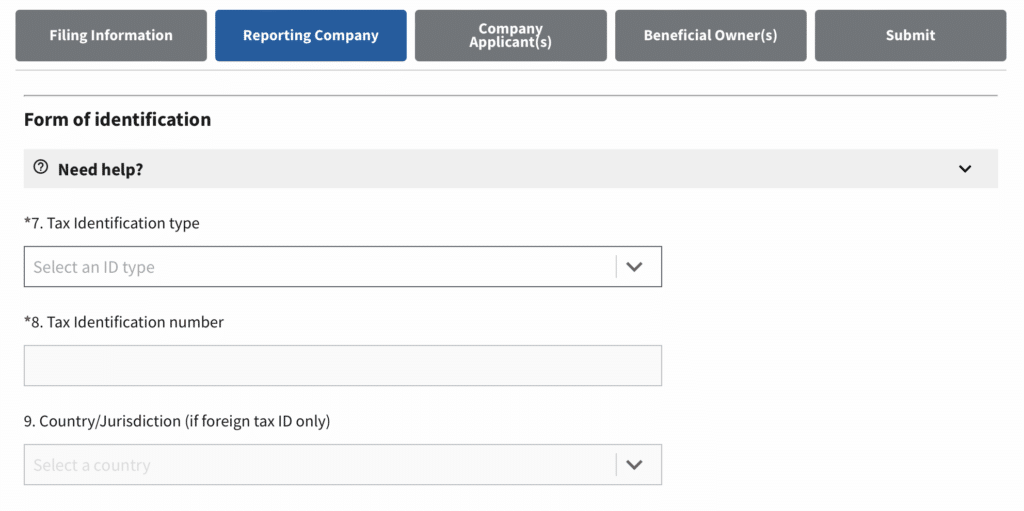

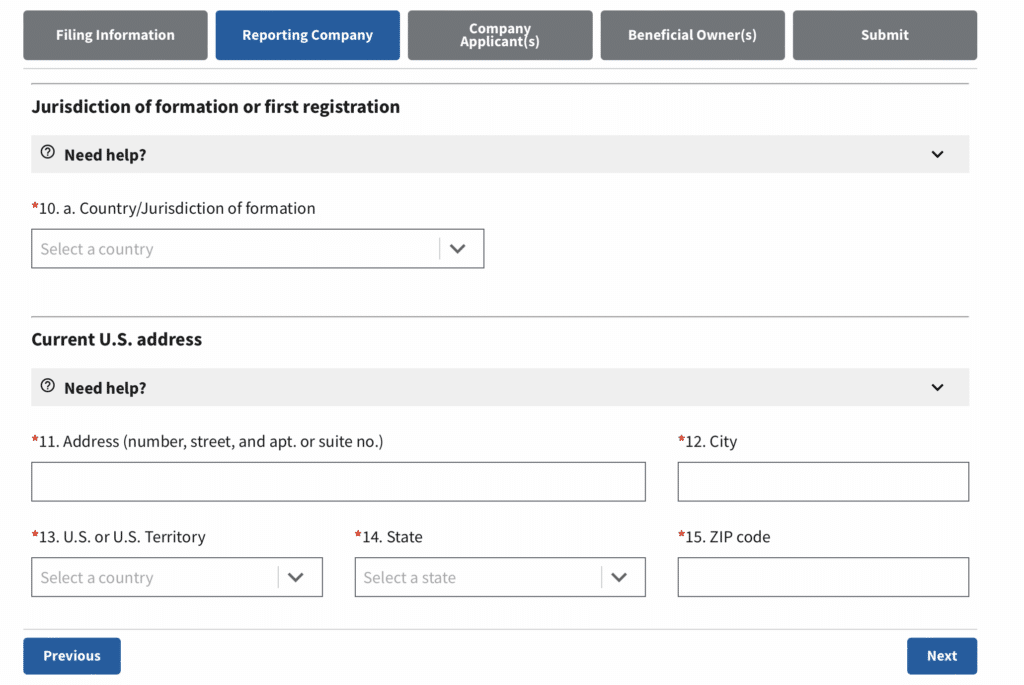

Your action items on this Tab are to:

- Click the box to Request a FinCEN ID in Question 3

- Enter your LLC’s legal name in Question 5

- If applicable, enter any DBAs or trade names in Question 6

- Use the dropdown in Question 7 to select EIN

- Enter your LLC’s EIN in Question 8

- Select United States in Question 9

- Select United States in Question 10 and then in the box that appears select the State where your LLC was created

- Complete Questions 11-15 with your LLC’s address

- Click the Next button

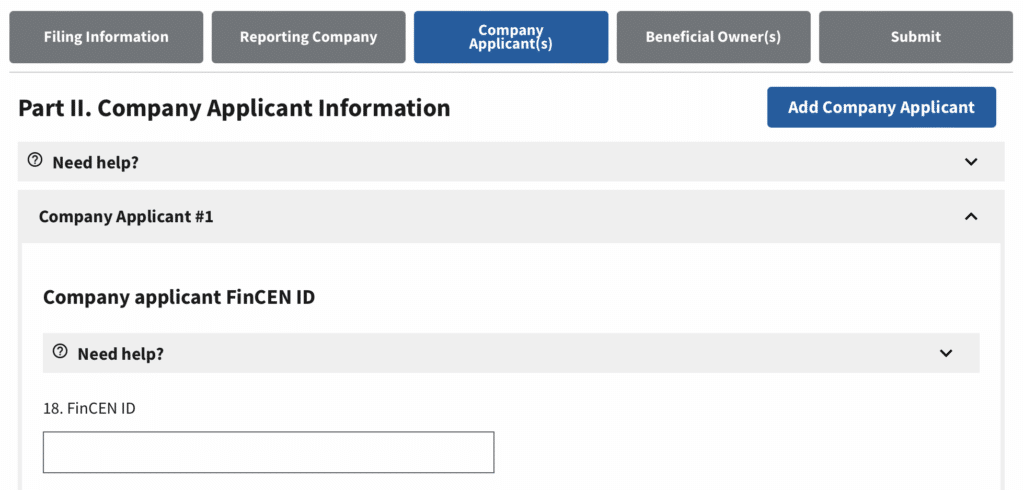

Company Applicant(s) Tab

The Company Applicants tab is only required if your entity was created after January 1, 2024.

It tells FinCEN who filed the paperwork to create the LLC/corporation.

A couple of notes about this tab:

- If your LLC was created before January 1, 2024, then check the box on Question 16 and then select Next to move onto the Beneficial Owner(s) tab.

- If your LLC was created on or after January 1, 2024, then you’ll need to provide the information of the person who signed the form (physically or electronically) that created the LLC. (This person/business is called the Company Applicant on this form.) This might be you, your attorney, or an individual at the company that prepared and submitted your LLC paperwork (e.g. LegalZoom) The legalese name for this person is the Organizer. If you don’t know who it was, look at the form you got back from your state that created the LLC and see who signed it.

If your LLC was created before January 1, 2024, your action items on this Tab are to:

- Check the box on Question 16

- Click the Next button

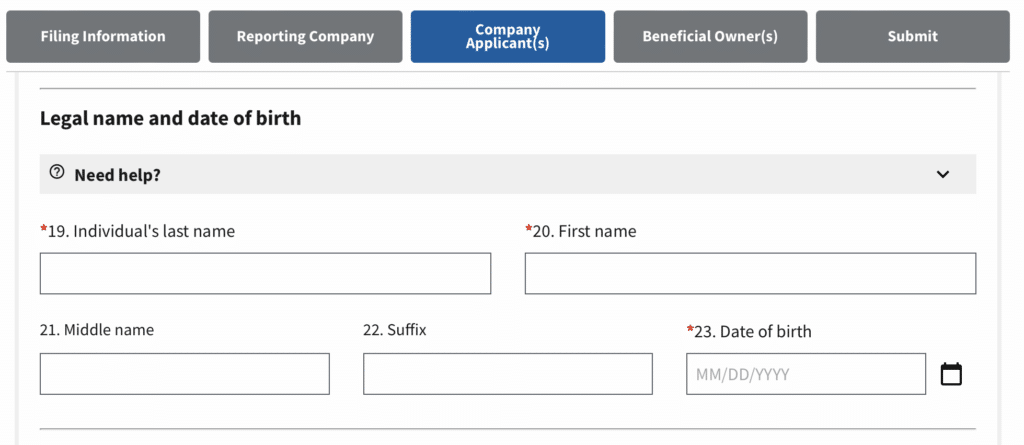

If your LLC was created on or after January 1, 2024, your action items on this Tab are to:

- If the individual/company that is the Company Applicant provides you with a FinCEN ID, then enter it in Question 18.

- If the individual/company that is the Company Applicant does not provide you with a FinCEN ID, then you’ll need to provide:

- Personal information in Questions 19-23, including legal name and date of birth

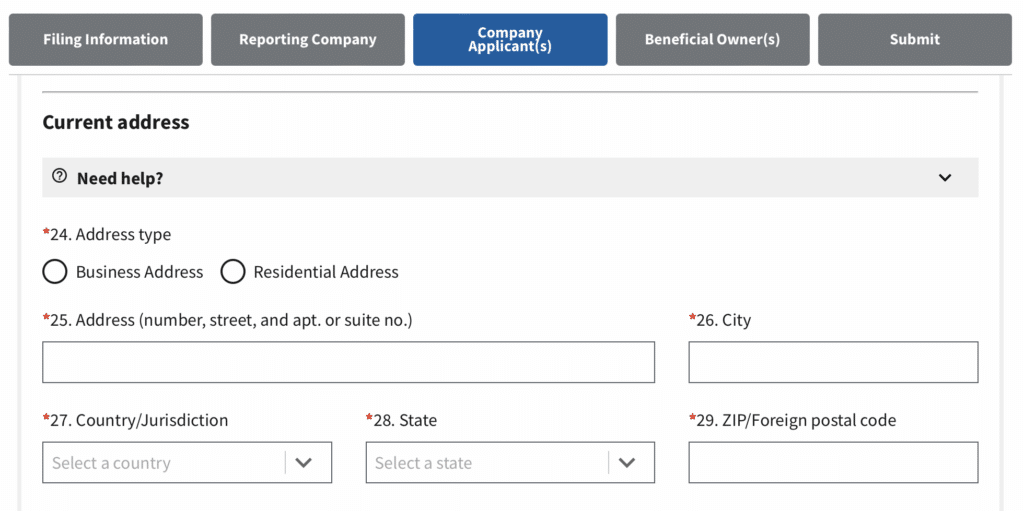

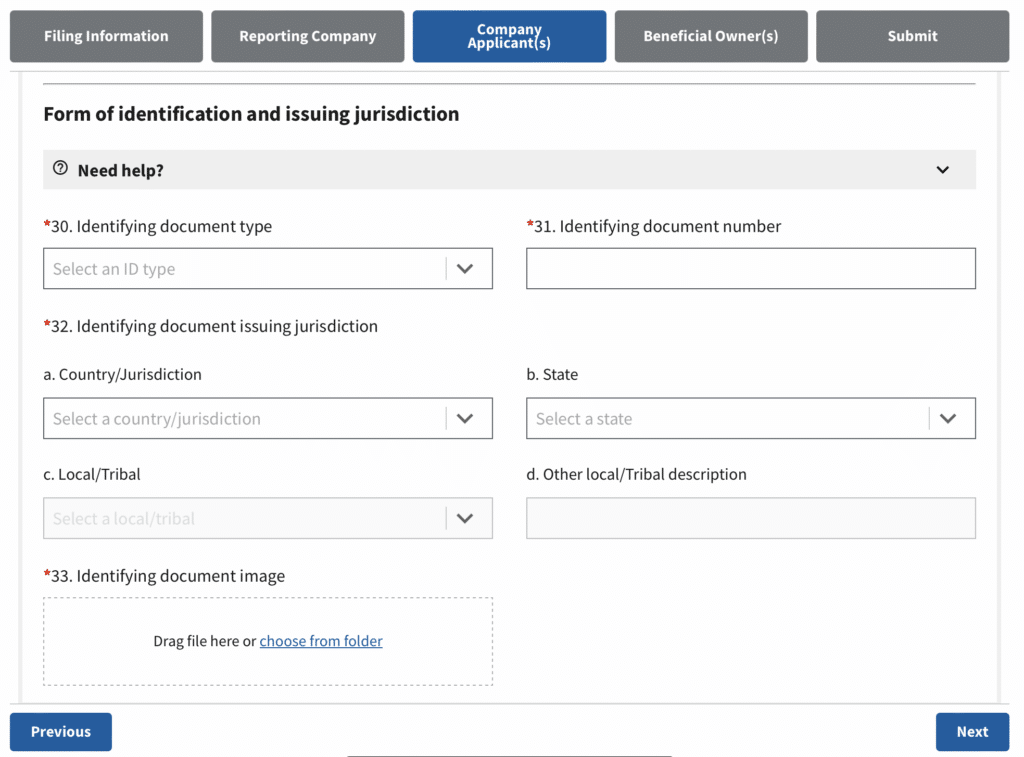

- Address information in Questions 24-29

- The details of their identification and upload a photograph in Questions 30-33.

- If there are multiple Company Applicants, click the “Add Company Applicant” button to enter information for each Applicant.

- Once you have entered the appropriate information, click Next.

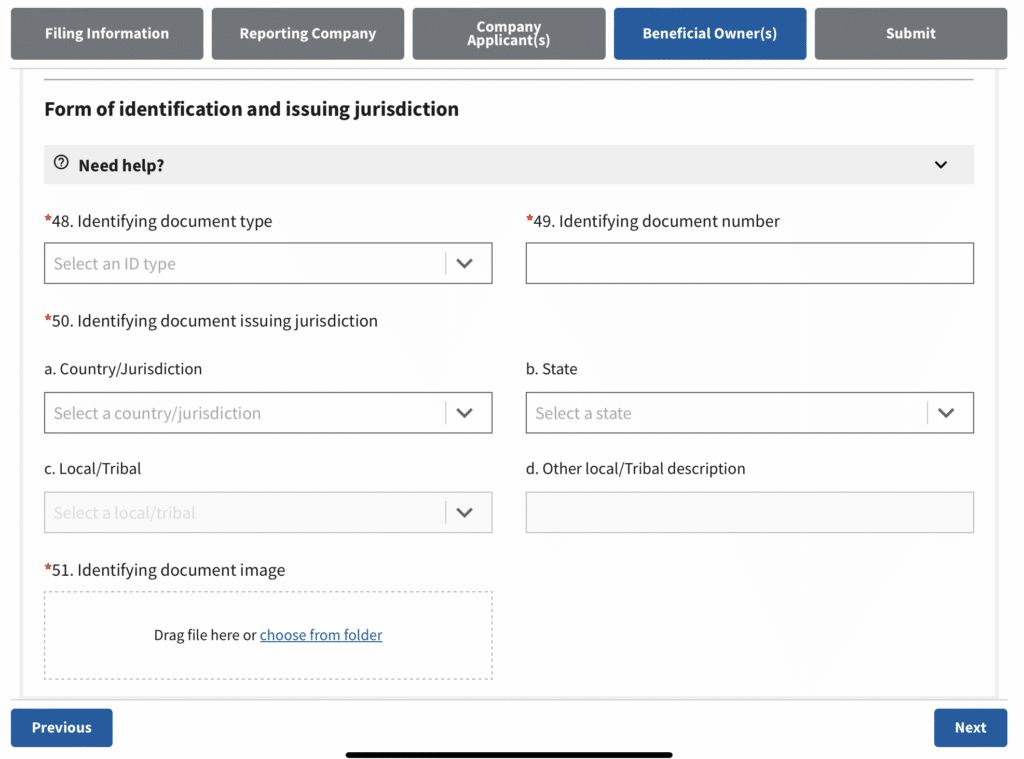

Beneficial Owner(s) Tab

On this tab, you report who owns the LLC/corporation.

A couple of notes about this tab:

- If a minor child is an owner, you’ll need to provide the information for the Parent/Guardian.

Your action items on this Tab are to:

- If the individual/company that is the Beneficial Owner already has a FinCEN ID, then enter it in Question 36.

- If the individual/company that is the Beneficial Owner does not have a FinCEN ID, then you’ll need to provide:

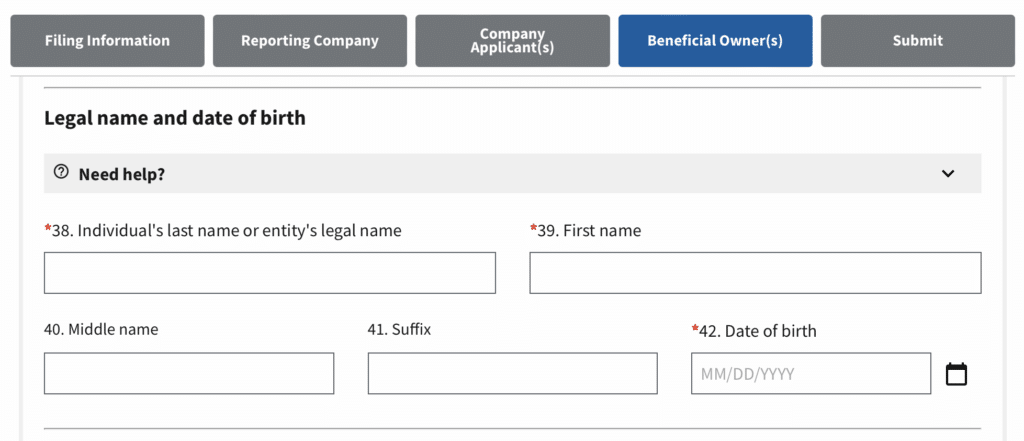

- Personal information in Questions 38-42, including legal name and date of birth

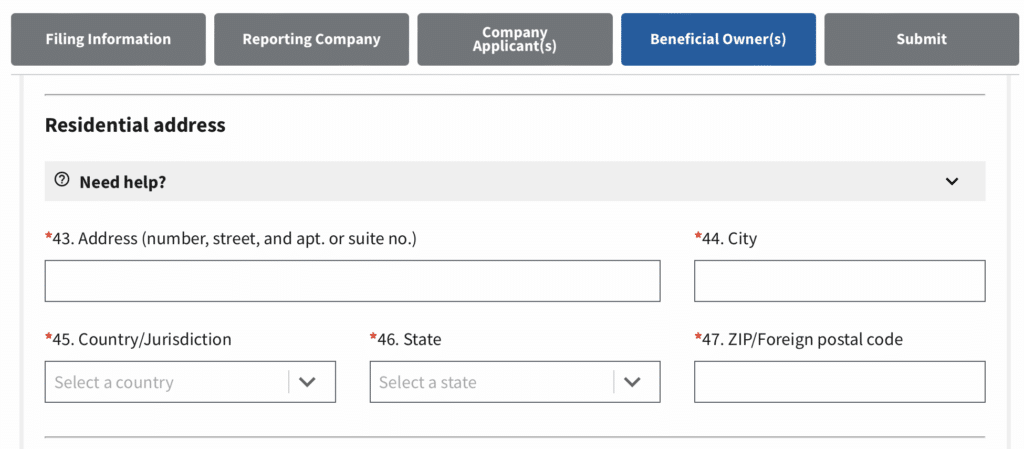

- Home address information in Questions 43-47

- The details of their identification and upload a photograph in Questions 48-51.

- If there are multiple Beneficial Owners, click the “Add Beneficial Owner” button to enter information for each Owner. (Limit of 99 owners)

- Once you have entered the appropriate information, click Next.

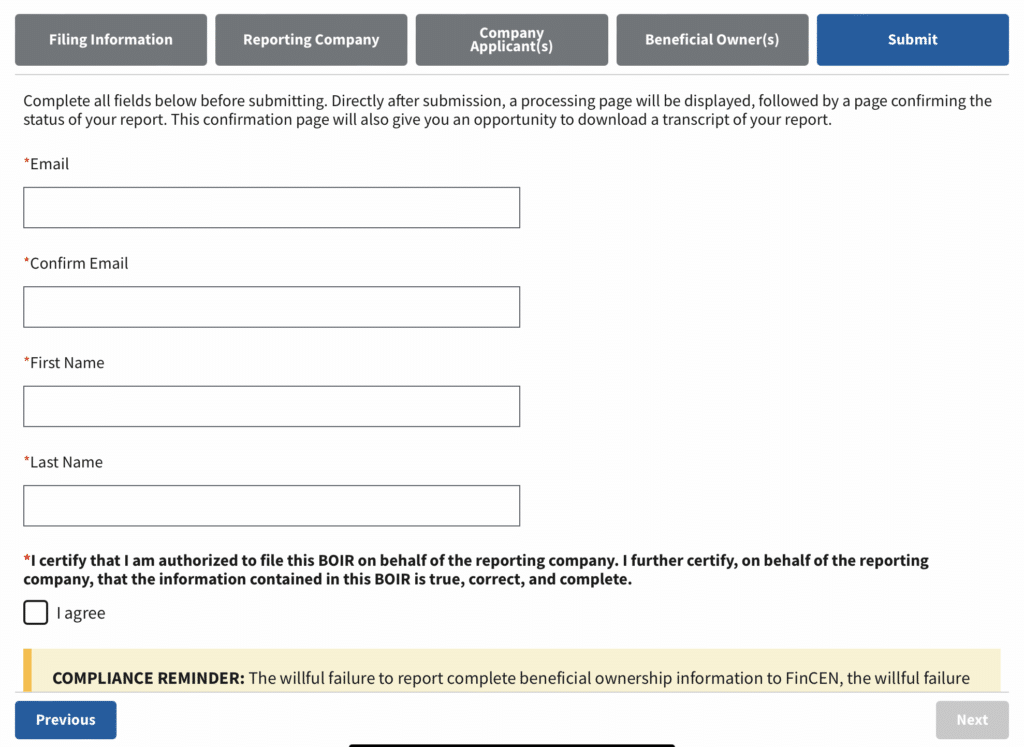

Submit Tab

On the final tab, you’ll enter the final details to submit your report.

Your action items on this Tab are to:

- Enter the email address and the name of the person submitting the report.

- Select the I agree checkbox to certify the report is correct.

- Clicking this checkbox will force the system to check your form and look for any missing information. If you need to fix anything, it will prompt you to correct it.

- Complete the hCaptcha textbox.

- Click the Submit BOIR button

Once you submit your report, you’ll see a progress bar and a confirmation page. You should download a PDF copy of your confirmation using the “Download Transcript” button.

#4. Keep your BOIR up to date

If any information on your report changes, you have 30 days to update your BOIR.

This might include:

- Changing your LLC address

- Adding/Removing a business owner

- Business owner moves or gets a new address

FinCEN has provided step-by-step instructions on how to update your BOIR report here.

Want to learn more about how to keep your LLC legit?

When you create an LLC, you in effect create a fake legal person, and because of that, it comes with some legal red tape. Do you know all the requirements to keep your LLC on the up and up?

My book, LLC For Your Creative Business, helps you do just that. It gives you a straightforward roadmap along with the tools and resources you need to keep your LLC fence strong so it will protect you if anything goes wrong in your business.

It can be overwhelming to know exactly what’s expected to keep your LLC on the legal up and up

Creating an LLC isn’t:

- as simple as shipping off a form

- a set-it-and-forget-it thing

- a magic bullet to prevent all liability

This book is designed to guide you step by step through the process of making sure your LLC fence remains strong–especially when you need it most.

(If you use the above Amazon affiliate link, we’ll make a small commission, but it doesn’t change the price you pay.)

Hi! I’m Kiff! I’m your friendly legal eagle (and licensed attorney).

My goal is to add ease to the legalese. And because I think basic legal resources should be available to every creative, I create a lot of free content.

If I’ve created something that has helped inject a little ease into your creative business and you would like to say “thank you”, you can make a contribution here.

If you’d like to hear more from me, I’d love to pop into your inbox every Friday morning to share additional ways to cut through the red tape and inject a little ease.

Get tips from your friendly legal eagle in your inbox…

Your privacy is important to us. Learn how we protect it here.